TOP 7 NYC OFFICE MARKET MYTHS DEBUNKED BY GREG KRAUT CEO KPG FUNDS

To ensure you don’t fall into the office market myth trap, here are some prevailing myths debunked

MYTH #7

Most tenants are trying to sublease their office space.

FACT:

CBRE reported that Manhattan office space newly put up for sublease—a key market bellwether—is at historically low levels. Only 234,000 square feet of sublease space was added to the market in May, compared with 340,000 square feet in April. For context, this compares to between 800,000 square feet and 1 million square feet monthly in pre-Covid months. The result is that only 21% of available space on the market today is made up of sublease space, compared to more than 40% of availability following the dot-com bubble. We view this as a strong sign that although overall absorption has slowed, firms are not ready to give up on NYC and in fact we are seeing pent-up demand building as the real estate market typically trails the stock market by 12 months.

MYTH #6

There is massive new construction oversupply coming to the market.

FACT:

New construction accounts for only 1% of the NYC office market is not enough to meet current demand. There is approximately 26.1 million sq. ft. of major redevelopments and new construction in NYC since 2016, with 64% of this already leased.

The appeal of new product to users indicates that more space could be leased before coming to market and lowering the availability rate. The trend of tenants leasing highly improved space has only been exacerbated by Covid and the needs of the modern workforce.

MYTH #5

Coworking is dead and will bring down the entire market.

FACT:

All coworking makes up only 3.9% of the overall market, with WeWork making up 1.9%. Additionally, coworking has averaged only 4.3% of all Manhattan leasing since 2014. While impactful, this is volume that can reasonably be absorbed within the Manhattan market and is far from a systemic risk.

MYTH #4

Most companies will be working from home and not making long term commitments.

FACT:

Several surveys have come out showing that both employers and employees want to get back to the office for several reasons. In one survey by Colliers, only 12% of respondents said they would like to work four days or more from home post-lockdown, with 49% saying they would like to limit work from home to a maximum of two days a week when the pandemic has subsided. Over the last 2 months there has been hard data of rents holding their value, several long-term leases and a large end-user taking over 200,000 SF for their first US location.

These long-term commitments represent unwavering confidence in the city.

Below are further indications of NYC office leasing demand in recent weeks:

- Since May 2020, over half of all office lease transactions were completed north of $90 psf. The top 4 deals averaged $110 psf.

- The average lease term since May 2020 was approximately 7 years.

- TikTok and Australia Super recently selected NYC for their US HQ and paid over $100 psf.

MYTH #3

NYC office is not a growth market.

FACT:

NYC was voted by the GBD Innovation Club as one of the top two gateway centers best positioned for office growth. It is based in part on a strong correlation between robust working-age (25-45), population growth and income growth to office rent growth. The concentration of talent, unparalleled business efficiency, and instant connectivity are fundamental strengths of Global Business Districts (GBDs).

According to Greenstreet Advisors, NYC is ranked Number 1 for the percentage of college degrees per capita at 78%, a compelling metric for employers. In addition, NREI ranked NYC as one of the top 9 most resilient markets. The New York office market has had sustainable rent growth of approximately 4.0 percent since 1942.

Although leasing velocity has temporarily dropped due to the city shutdown, several tenants are continuing to hire employees and lease space within the city, which is extremely encouraging. According to Build NYC, NYC-based tech companies raised a significant amount of capital in June 2020, with the top 5 raising a total of $537 million through venture capital and as Lemonade becoming the top tech IPO of 2020. This capital is expected to create hundreds of jobs immediately within the city, which ultimately leads to an increase in the need for office space. Over 95% of these job positions are expected to be NYC based.

MYTH #2

NYC has lost jobs over the last 20 years due to the dot-com bust & 9/11 and The Great Recession when Lehman and Bear Stearns went bankrupt.

FACT:

While no city is completely insulated from macro events, NYC has a history of not only recovering, but thriving.

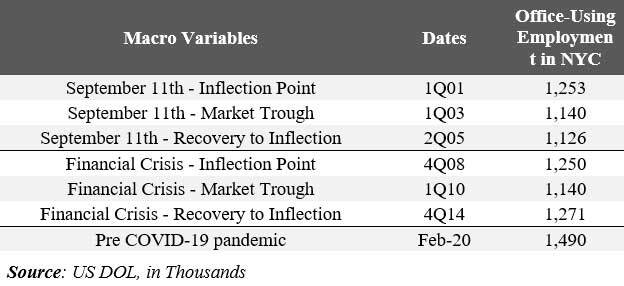

The best examples of this are to look at how New York City recovered following September 11th and the 2008 Global Financial Crisis. As shown below, total office using employment surpassed pre-crisis peaks in both instances. In addition, if NYC were to lose 10% of the permanent workforce (which would surpass the last 2 recessions), we would still have over 100,000 more jobs than the last 2 peaks.

MYTH #1

There is a mass exodus of tenants out of NYC.

FACT:

NYC has a diverse private sector employment base and one of the deepest, most diverse talent pools in the world. The city is home to 65 Fortune 500 companies and over the last 12 months there have been several large employment expansions: Google, JP Morgan, Amazon, Disney and several other firms have announced plans to expand and spend significant capital expenditure in NYC.

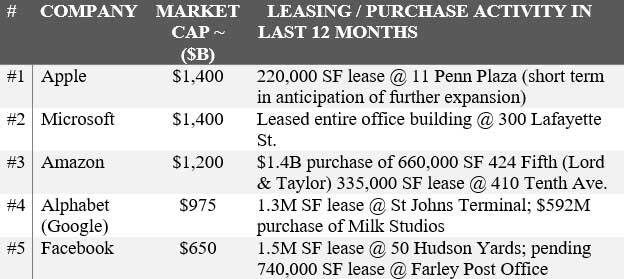

The city now has a strong financial, media, technology and rapidly growing life science sector. Most compelling is the New York City activity of the five American firms with the largest market capitalizations:

These firms are the greatest creators of American wealth, and not coincidentally, the most reliant on pure intellectual capital. Even though they were founded elsewhere, each continues to expand in New York, augmenting already substantial commitments to ensure continued access to talent.

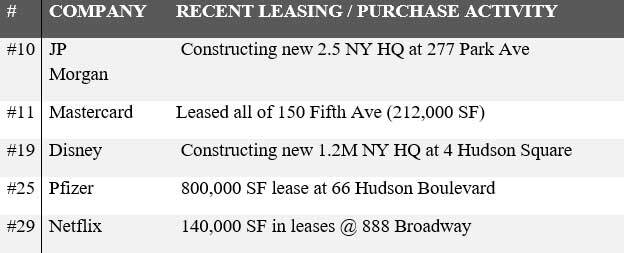

Other top 30 market capitalization firms making large recent commitments to NYC include:

The primary ingredient to overall results for these firms is access to talent. That “knowledge capital” access and the city’s historical resiliency is what makes NYC an attractive city for employers over the long-term.