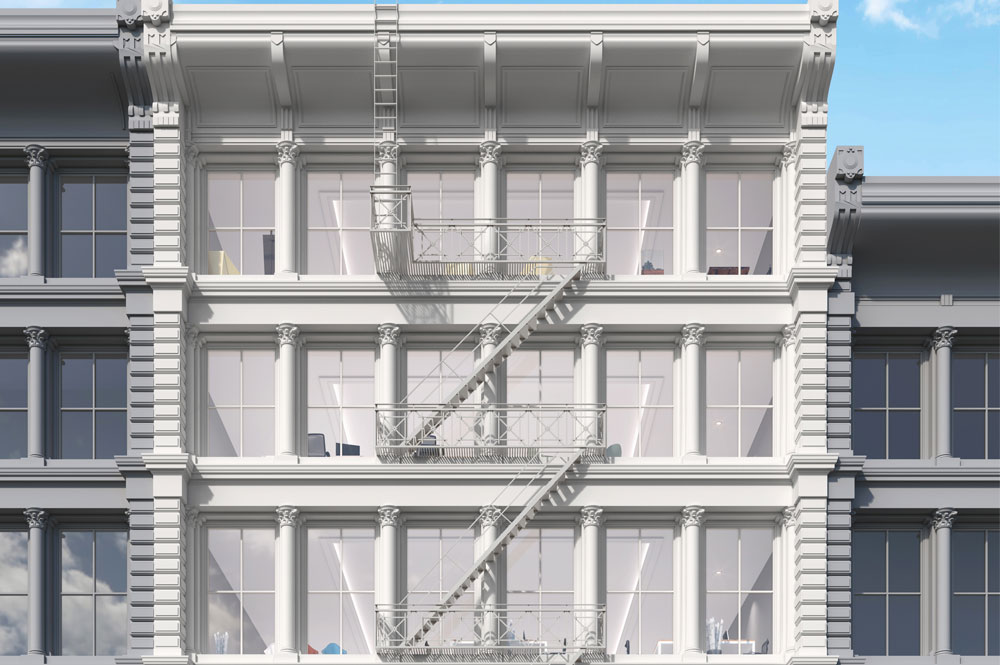

KPG has redefined modern offices.

BUILDING THE FUTURE OF NEW YORK CITY

ABOUT KPG FUNDS

KPG is a value-add owner and operator that purchases architecturally significant but aging Class B and C properties and converts them to modern Class A. KPG’s design-forward brand attracts and retains the modern-day workforce. With over 50 years combined experience based in NYC, KPG manages fully discretionary institutional vehicles that are privately held and management-owned.

COLLABORATIONS

SERVICES

KPG DESIGN

KPG collaborates with top designers to give our tenants a unique but functional bespoke workplace experience.

KPG DEVELOPMENT

KPG oversees each project through design, development, management and leasing with precision and direct management.

KPG MANAGE

KPG optimizes the value of its properties through detailed transaction and management execution and utilizes superior performance measurement and cash-flow forecasting to inform investors.

PRESS

Fed’s Rate Cut Signal Represents Golden Real Estate Buying Opportunity In NYC For First Movers

As interest rates go down, property values will sky rocket from historical lows. This will be the last chance for institutional capital to get off the sidelines before values soar.

CONTACT US

Please complete the form below to contact us.