NYC OFFICE AND RETAIL COMMENTARY

SL Green Realty’s (SLG) CEO Marc Holliday on Q1 2020 Results

If you haven’t had a chance to listen to the earnings call from NYC’s largest office landlord, now is your chance to hear what is really happening in NYC. Will companies come back to NYC? Are leases being signed? Are tenants paying rent? Will companies need less space? How long will construction be affected?

I’d love to hear your feedback.

NYC always comes together and bounces back stronger than before.

Greg Kraut

Co-Founder & CEO, KPG Funds

[email protected]

212-359-0743

PRE COVID NYC

NYC had record low unemployment and record high leasing pipeline, near 0% vacancy across our portfolio, incredible progress on the construction and leasing of One Vanderbilt and a sense of growing stability in the retail sector. But that was 8 weeks ago and for all intents and purposes, a lifetime ago.

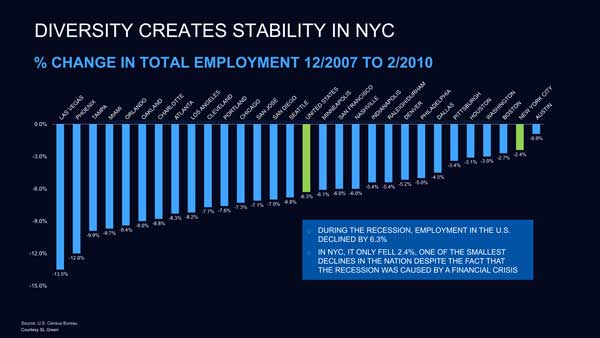

NYC HAS A DIVERSE AND RESILIENT TENANT BASE

New York City office buildings has many essential businesses, organizations and agencies that work in our portfolio that are critical to keeping this city running. Medical offices, health care companies, visiting nurses, major media outlets and broadcast studios and governmental agencies all have offices in our buildings. These tenants simply don’t have the option of working from home, they are the people on the front line who need assurances that they can operate in buildings that are open, operating, secure, serviced and free from COVID-19.

WHEN ARE WE GOING BACK TO WORK?

While no one yet is certain how and when the restrictions will be lifted, we are planning for a partial return to offices sometime in the second half of May with ramping up occurring over June and July.

ARE COMPANIES COMING BACK TO WORK IN NYC?

What we are hearing from our tenants is that employees will want to return once the restrictions are lifted, work from home has proven serviceable at best. However, businesses are currently operating far below total capacity and capability, and there is simply no substitute for working in purpose-built environments, free of home life distractions in a collaborative setting, which nurtures creativity, comradery and collaboration. The future of work will not be at home, in a bedroom with a laptop computer and spotty WiFi connections with family members doing video bumps. But undoubtedly, COVID-19 has changed the perception of what businesses want in work environment. If people want to be at home, there’s always — even before COVID, people who want to work from home. But we’re hearing from our tenant base, most people are saying, this doesn’t work. How do you do new business solicitations? It’s 1 thing to do internal meetings or Friday happy hours amongst your employees or maybe having these virtual happy ERs or maybe doing some other kinds of meetings with existing relationships. I haven’t heard anybody say it’s preferable to be on a computer screen at home than in the office. And all this technology, it’s not new technology. People have been doing video conferencing for years and years, there’s nothing new. We don’t want tenants to take more space than they need because that only creates problems down the future, they should only take what they need. And often, they don’t take enough, and they need growth space, and that causes problems for them. If they feel that 5% or 10% of their workforce can work from home on a video screen. We believe that people are at their best in the kind of space we have. It’s enhancing to the experience, natural light, tall ceilings. Collaboration, but with bigger workstations, the ability to mix in CAFE conferencing, workstation. It all, I think, still works.

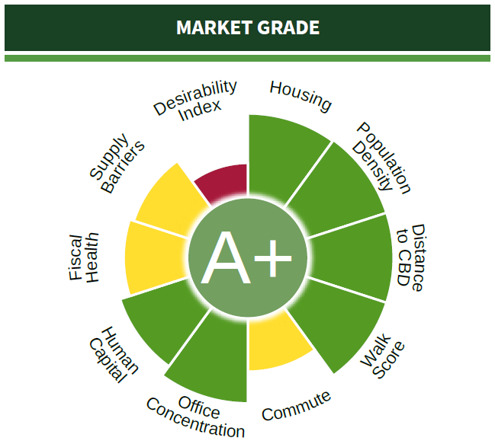

A+ Rated Office Market Positioned for Growth

- NYC is ranked Number 1 for % of college degrees per capita at 78%

- NYC has an Occupancy Rank in the top 5 at 92.5%

HAS RENT COLLECTION PLUMMETED?

On the tenancy and leasing front, we are very fortunate to have largely creditworthy office tenants and long-term rent rolls. And accordingly, we did not experience significant delinquency or fallout on office collections in April, having collected over 90% of our office rents, over 60% of our retail rents, and we will exceed 86% of collections overall. We think retail rents based on the commitments we have in place today will approach 64%, and we will end up at around 87% overall come April 30. We’re working with these tenants, and we understand the challenges that some of them are facing, particularly our retailers, they’ll be extraordinarily challenged during these times, and we’re attempting to work with those smaller tenants that have been most impacted during this time. We certainly have asked that our larger tenants and credit tenants pay their share as it was evidenced they did, so that it gives us the latitude and flexibility to work with the most impaired, generally smaller tenants generally in the retail community, who right now have been shut out of business.

ARE LEASES BEING SIGNED AND WHAT IS THE STATUS OF THE PIPELINE OF TENANTS?

We nonetheless got some leases signed actually last week. We have 1 more tenant pending that we hope can be rounded out in the near-term. A lot of tenants still telling us they have every intention of going ahead with the leases we have been pre negotiating, but I think people do want to take a month or 2 pauses, while we work through the situation. Pre-Covid, we had another 7 deals that were in ongoing term sheet negotiation, covering about 150,000 square feet. We’ve kept in touch with those tenants, obviously, the larger ones of that group still are signaling that they want to reengage once they have clarity, when everybody is back in the office. So, we closed these past 2 deals out in pretty quick order over the past 10 days and another lease that we’ve got for about 27,000 square feet. I just want to be clear, that 815,000 SF in our pipeline. That was excluding 600,000 feet of additional pipeline that was — we would have told you 2 months ago, we were going to make and has been put on hold, not dead deals, but whole. Now not all of that [600] will come back. But even if half of that 600 to comes back a fraction of it, on top of the existing pipeline, that would still support our business plan. I mean maybe tenants are going to look for some additional concession on free rent. As we sit here today, we have 275,000 square feet of leases that are out for execution or an active document negotiation. We have another 540,000 square feet of term sheets. Those are term sheets that we think have a reasonably high probability of converting over to leases. But then on the transactions that were delayed as a result of COVID, we had 267,000 square feet of leases that were out in negotiation. And another 340,000 square feet of term sheets. So, another 600,000 square feet that make up the combination of all of that is the [$1.4 billion] that markets talking about. We’ve had an ongoing series of meetings with them, video chats, obviously, and that continues to move forward And probably doing on shorter deals, 2 to 5-year type deals from the tenant’s perspective, where they want to preserve their capital and to see where the world shakes out.

ARE RENTS GOING TO DECLINE?

We’re hopeful that rents are going to hold because I think what you’re going to see is just a period of sale made. It’s not going to be a period of rent decline. I think you’re going to see people who have put deals on hold, and we’ll revisit. We’re hoping they all come back. That pipeline I gave you earlier, I just want to be clear, that 815,000 SF in our pipeline. That was excluding 600,000 feet of additional pipeline that was — we would have told you 2 months ago, we were going to make and has been put on hold, not dead deals, but whole. Now not all of that [600] will come back. But even if half of that 600 to comes back a fraction of it, on top of the existing pipeline, that would still support our business plan. I mean maybe tenants are going to look for some additional concession on free rent.. That delayed amount of deals I don’t think those requirements are going away. So we have a high degree of hope that those tenants reengage with us, and it’s a matter of time — the feedback that we’re getting from tenants right now is people are going to wait and see as far as where the market goes, but the immediate reaction is probably a push on the concession side, whether that’s a few more months free rent or a little more in TI and not as much as a dramatic drop in face rents.

WILL COMPANIES NEED LESS SPACE?

As far as space needs, it’s an interesting conversation. There’s a lot of discussion with tenants who are trying to figure out exactly how they’re going to plan for their space. There’s no doubt that the phenomenon of densification, which really started in 2011, had played itself out and that even before COVID, there were a lot of businesses that were starting to go the opposite direction where they were where they’re going to assign more square footage per employee than before. And I think now as a result of COVID, there’s a consistent message that we’re feeding — that we’re getting back from tenants that they’re going to come back, they’re going to redesign spaces, they’re going to allocate more square footage in order to provide distancing between employees. And so, does that mean that tenants end up taking more space in the long run? Maybe yes, maybe no, it will probably be offset by some tenants that then don’t do consolidations but split their operations for diversity. But clearly, the phenomenon of densification, that is — that’s gone. There’s 1 other component of that that people aren’t thinking about, is that a lot of big companies do hoteling. The concept of having 120 employees, but only 100 seats. That phenomenon, too, is going to start to go away such that every employee is going to want their own seat. I’m not going to want to share my seat with somebody else because everybody is going to have a heightened sense of clumsiness. And that cost densification will add to the space allocation per employee as we go forward. And helps to offset any of the small number of employees that work from home

HOW LONG WILL CONSTRUCTION BE AFFECTED?

I think a lot of the workers will waive premium time or substantially reduced premium time. We will be working through shifts, by working in shifts, you can keep distancing. You can allow them space. You don’t have to be 100% for 1 shift, you can be 50% for 2 or 3 shifts or even less. So there are some changes that are going to take place. There are opportunities to make up time and were going into that time at the right period because with the summer hours, we can really make up a lot of time.