CORONAVIRUS PANDEMIC HAS SOURED INVESTORS' SHORT-TERM OUTLOOK FOR BIG APPLE OFFICE MARKET

Short-term pain leads to long-term gain due to pent up demand, growing tenant diversity and limited supply

Will Muoio – REFI US (March 24, 2020) –

Long-term structural changes in and around the office sector is affecting the short-term impact outlook for New York’s commercial real estate market, with fund managers and institutional investors seeing the coronavirus pandemic leading people to revert away from the traditional workspace. But Gregory Kraut, CEO of local investment shop KPG Funds, is confident that New York will bounce back. …continued below

KPG FUNDS BRIEF HISTORY OF THE NEW YORK CITY OFFICE MARKET:

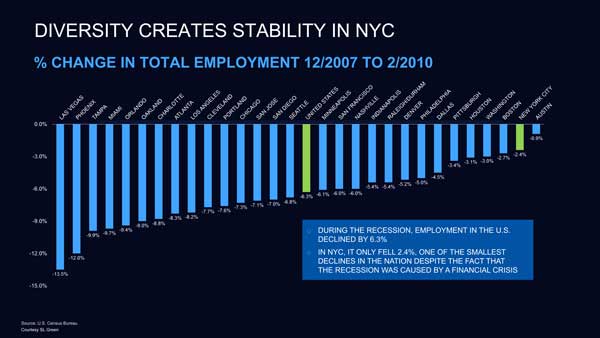

During the great recession employment in the US declined by 6.3%. In NYC, it only fell 2.4 % (2nd lowest ) despite it actually being a financial recession.

“New York commercial property’s steady growth through all economic cycles has historically been a safe harbor for investors trying to insulate themselves from other, unsure real estate market sectors,” said Kritsberg.

“Despite uncertainty in the broader markets today, we strongly believe in the resiliency and long-term strength of New York City commercial real estate. With a continued focus on well-located, well-managed boutique office buildings, we’re excited to extend our track record of delivering a great tenant experience and strong results for our investors,” added Kraut.

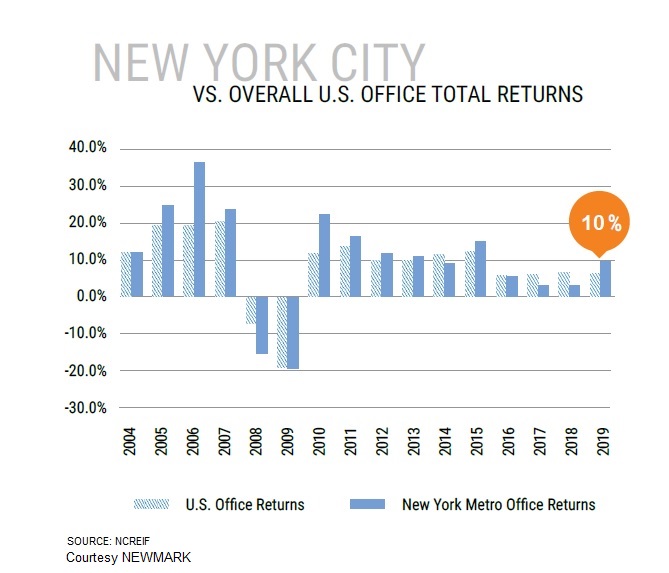

New York City, Washington DC, and San Francisco outperformed the general office market by over 6.5% in 2010, with New York City beating the general market by more than 10%.

“There are great medium term investment opportunities, we have always been bullish on NYC and now we are even more bullish ” said Kraut.

“Liquidity , capital and market specialization are king right now,” said Rod Kritsberg, Chief Investment Officer of KPG Funds . “Managers with capital ready to invest can play offense at a time when most are forced to play defense.”

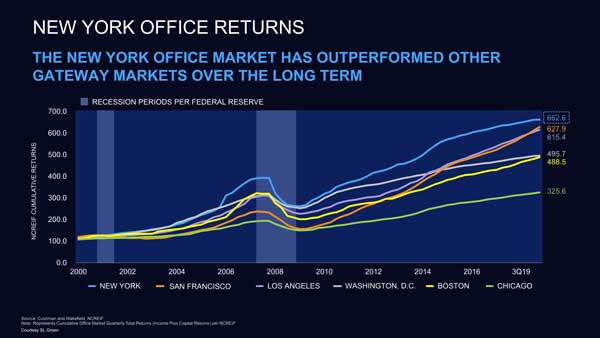

The New York Office Market has outperformed every other gateway market over the long-term

… Short-term pain leads to long-term gain with pent up demand, tenant diversity and limited supply

Cap rates for core assets may trend higher in Manhattan due to fear and confusion surrounding the pandemic. But as a value-added owner that focuses on New York, KPG Funds sees the market a bit differently than some of its peers. The firm manages institutional vehicles on behalf of its investor base and is continuing to source opportunities in the current market.

“[Our investors] understand the fluid nature of the environment and for now everybody is working together,” said Kraut.

Similar to many of its peers, the KPG Funds team is working remotely. This is out of the norm for the company and is also something that Kraut doesn’t believe will become the new norm. Within its current business, the firm has been actively working with tenants to find out the best way moving forward in terms of rental adjustments – especially given their approach of viewing tenants as partners.

“We think there will be a lot of value and liquidity in the future. New York City always comes back” – Greg Kraut, KPG Funds

There continues to be selective liquidity in the debt markets, with commercial banks continuing to offer competitive rates. While insurance companies are reluctant to establish floors, hedge funds and debt funds continue to offer liquidity facilities particularly for TOE, or time of the essence closings. This is a change from a few weeks ago before the severity of the outbreak was recognized, Kraut said, noting that lenders might have cancelled loans or offered loans with huge spreads.

KPG Funds doesn’t know how the markets are going to react next and how long of an impact this will have. By sticking to its specific investment focus, the firm knows by prepping for the worst and launching austerity measures they will be ready when the uncertainty fades away.

We believe in New York…

“We believe in New York, so we view this as a unique window of opportunity to benefit from ongoing uncertainty in the market. As an investor that focuses almost exclusively on architecturally significant middle-market office buildings in New York City, we’re confident in our ability to leverage proprietary sourcing capabilities and uncover undervalued assets or other special situation investment opportunities across market cycles,” said Gabe Sasson Managing Director, Fund & Portfolio Management.